Card Management For Debit & Credit Cards

The Card Management feature of Online & Mobile Banking lets you manage your SF Fire Credit Union debit and credit cards anywhere, and at any time. You can use this feature to:

- Turn your card on or off with immediate effect

- Create and manage alerts for your card transactions

- Activate your card

- Add travel notes

Card Management Options

When you open the Card Management widget, you’ll be able to see all your active SF Fire Credit Union cards, whether debit or credit card. When you select a specific card, you’ll access your management options:

- Turning your card on or off

- Setting up transaction alerts

- Replace your card in seconds if lost or stolen

Registering Your Card

You might need to "set up" your card first before you can access your management options. All your issued cards should appear in Card Management, but if the status reads "Not set up", scroll down to click the "Set up" button, then select "Continue."

You'll be able to select your preferred notification options (Push Notification, SMS, or Email) and confirm that your contact devices, numbers, and email addresses are correct. You'll then use the "Register" button to finish setting up your card.

Turning Your Card On Or Off

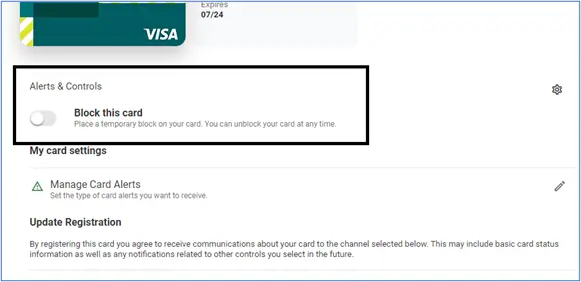

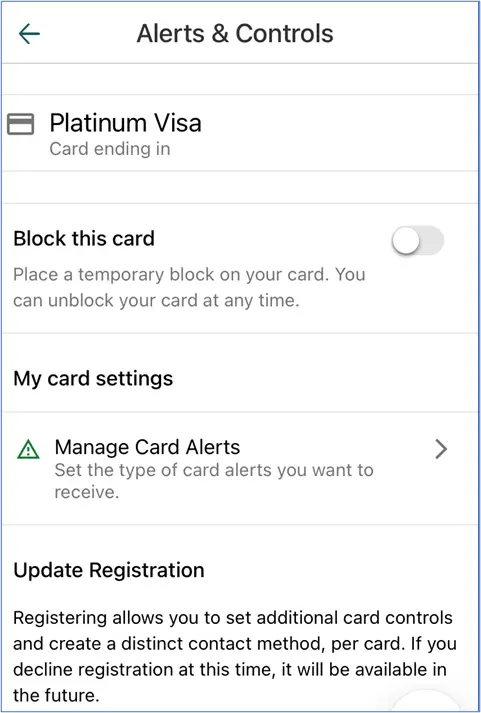

At any time, you can turn your card on or off by toggling “Block this card” under the Alerts & Controls menu. This change takes immediate effect. You would most often use this feature if you misplaced your card or you suspected unauthorized activity.

Desktop view

Mobile Banking view

Turning off your card blocks any new purchases from being authorized until you turn the card back on. However, if a transaction was already authorized, it will still post to your account. If you notice fraudulent charges pending, turning the card off will block additional activity, but pending items will often still post and require a dispute.

Manage Card Alerts

The Manage Card Alerts function of Card Management lets you choose to receive Push Notifications, SMS text messages, or emails to notify you of specified activity. You can choose to receive notifications for:

- Any transaction using the selected card

- Only transactions that exceed a set limit

These alerts differ from the Balance Alerts you might have previously set up in that these are real-time alerts. That means you will get a notification as soon as an authorization is posted.