SF Fire Credit Union Student Loans – Terms & Conditions

Loan Rates & Fees

Your Starting Interest Rate (upon approval) is:

| FICO® Score | 730+ | 660-729 |

|---|---|---|

| APR | 6.25% | 7.25% |

As of October 31st, 2021, your starting interest rate will be as low as 6.25% for FICO® Scores of 730+ or 7.25% for FICO® Scores between 660-729. Rate discounts may apply for setting up auto-pay.

The interest rate you pay will be determined after you apply. It will be based upon your credit history and other factors. If approved, we will notify you of the rate you qualify for.

Your Interest Rate during the life of the loan: Variable-Rate Loans

The Annual Percentage Rate is subject to increase after consummation. The interest rate will be adjusted quarterly, based on changes to the Index. The APR will not exceed 18.00%, nor fall below the Floor rate of 6% (for FICO® Scores of 730+) or 7% (for FICO® Scores between 660-729) regardless of the Index or any additional rate discount. Any increase in the Index may increase the APR and the amount of your monthly payment.

The "Index" for the quarter beginning October 1st, 2021, is 3.25%, which was the Prime index published in the Wall Street Journal on the first business day of September 2021.

Current offered rate(s) are calculated by using the Index, Margin and Floor value(s) in effect. Your specific Interest Rate, Margin, Floor, and/or credit approval depends upon the credit qualifications of the student borrower and co-borrower (if applicable). Margin will be disclosed at account opening. Student borrowers may apply with a creditworthy co-borrower which may result in a better chance of approval and/or lower interest rate.

Your loan amount will not exceed the cost of attendance less financial aid as certified by your school.

Loan Fees

Application Fee: $0

Origination Fee: 0%

Prepayment Fee: 0%

Late Charge: $15 (after a 15 day grace period)

Returned Check or Insufficient Funds Charge: $20

Payment Example

Minimum payment amount is $50.

Payment Example: A 25-year loan of $75,000 with a variable rate of 7.25% would have 300 payments of $542.27 once you enter full repayment. Rates are subject to change. Other rates and terms are available.

Federal Loan Alternatives and Disclosure Regarding Benefits

- You may qualify for federal education loans through a program under title IV of the Higher Education Act of 1965 (20 U.S.C. 1070 et seq.). For additional information, contact your school’s financial aid office or the Department of Education at: studentloans.gov & studentaid.ed.gov/sa.

- Think carefully before taking out a loan with SF Fire Credit Union. You are encouraged to start with grants, scholarships, savings, and federal student loans before utilizing private student loans.

- Private education loans are not eligible to be included in a Federal Direct Consolidation Loan.

- See http://studentaid.ed.gov/types/loans/federal-vs-private for a description of the benefits and repayment options available to federal student loan borrowers.

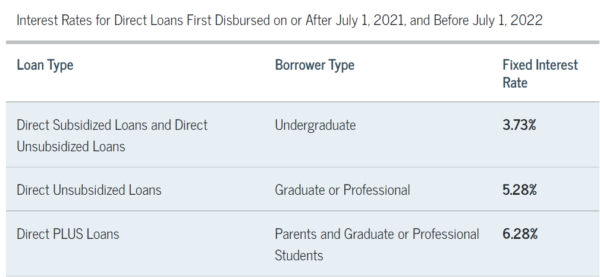

Table courtesy of https://studentaid.gov/understand-aid/types/loans/interest-rates

Next Steps

- Find out about other options.

The Federal Direct Consolidation Loan may have student loan benefits and terms not detailed on this form. Visit the Department of Education’s website at www.StudentLoans.gov for more information about other consolidation loans.

- To apply for this loan, complete the application.

If you are approved for this loan, the loan terms will be available for 30 days (terms will not change during this period, except as permitted by law).

Repayment Options

You may choose to make interest-only payments while in school; defer both principal and interest payments until six months after graduation; or make full payments while in school. If you defer both principal and interest payments during school, interest begins accruing at disbursement and will be capitalized when you enter repayment.