Let's work together to get you where you want to go. Our high-yield savings options make it easier to put away and grow your money.

You work hard for your money. Join SF Fire and keep more of it.

| SF Fire Credit Union | Chase1 | |

|---|---|---|

| Minimum Balance |

SF Fire Credit Union

$0

|

Chase

$25

|

| Minimum Opening Deposit |

SF Fire Credit Union

$0

|

Chase

$25

|

| Monthly Fee |

SF Fire Credit Union

$0

|

Chase

$5

|

| APY | up to 4.00%2 |

Chase

0.01%

|

Our Savings Accounts

MONEY MARKET

4.00% APY* on your savings

No balance minimums or monthly fees making it easy to access your funds while earning a higher rate. Account must be funded with money not currently held at SF Fire Credit Union.

TIERED SAVINGS

Earn dividends while keeping your money available

Enjoy great features like instant account transfers, free ATM access, and overdraft protection.

TERM CERTIFICATES

Maximize yield with our term certificates

With a minimum balance of just $250, and terms from 3 months to 5 years, we offer term certificates for every need.

HEALTH SAVINGS ACCOUNT

Take the sting out of medical expenses

Plan for future medical costs with our smart, easy-to-use HSA account.

EDUCATIONAL SAVINGS ACCOUNT

College will be here before you know it.

And with rising education costs, it’s important to have a college savings plan. Start saving today with a Coverdell Educational Savings Account. When the time comes, spend less on books and more on balloons.

HOLIDAY SAVINGS

The holidays can be stressful, but we’re here to help.

If you start saving with our high-yield Holiday Savings account, you can snatch up the season’s hottest items and make sure it’s the most wonderful time of the year.

Frequently Asked Questions

-

Can I open additional checking and savings accounts through Online Banking?

-

Do I have to share a log-in with joint owners?

Discover More

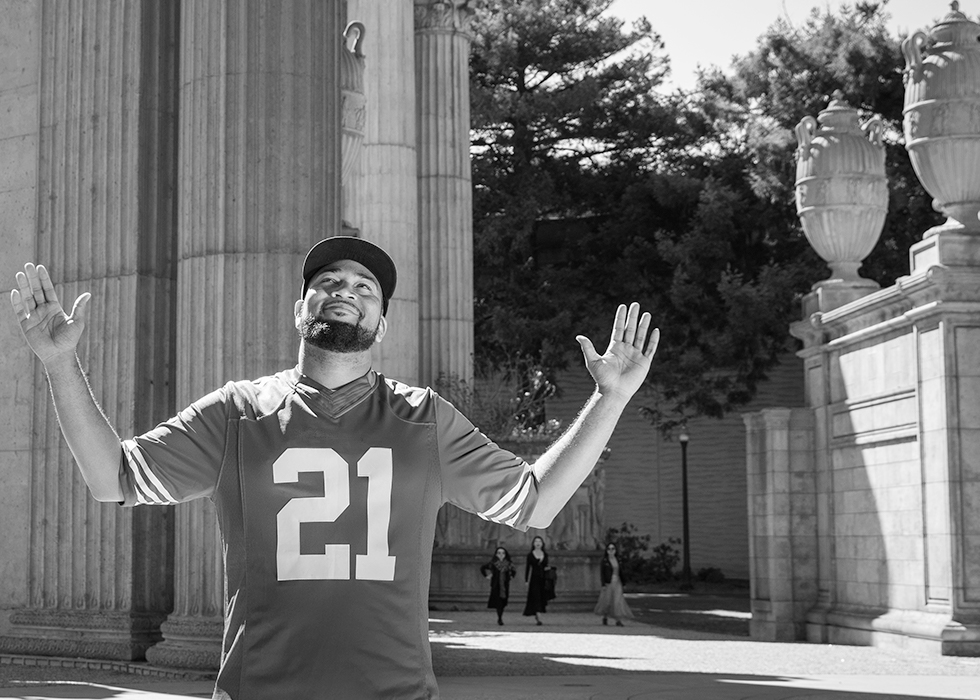

Putting him first since 2012.

Jump start your emergency savings fund

An emergency fund is a good way to prepare for unexpected events by giving you a financial cushion to handle emergencies without going into debt.

Learn More

Putting him first since 2012.

Putting her first since 2005.

Say goodbye to credit card fees

Get the card that cuts out the fees while giving you rewards, overdraft protection, and lower rates.

Learn More

Putting her first since 2005.

Let's Chat

As a local credit union, we measure our success one member at a time. We want to get to know you and help you achieve your goals. Come into a branch or call us today. Our people are happy to serve you.

Stop by a branch

Branch hours

Mon – Fri 9:30 AM – 5:30 PM

Saturday 10:00 AM – 2:00 PM

1 Chase rates and fees as of 1/17/2024

2APY= Annual Percentage Yield. The APY is the effective annual rate of return and assumes that the funds will remain in the deposit account for the full 365 days. This rate schedule states rates applicable to specified accounts. This schedule is incorporated as a part of your account agreement with SF Fire Credit Union. A minimum positive balance of $0.01 is required for dividends to be earned, which are calculated at a specified rate over a given period.

Rates effective as of 12/15/2023 and are subject to change at any time without notice. New money refers to money not currently held at SF Fire Credit Union accounts or funds that have been in another SF Fire account for 30 days or less. Incoming transfers are limited to external sources. There are no restrictions on the amount or timing of external transfers into the Money Market Account.